oregon statewide transit tax 2021 rate

Oregon Statewide Transit Tax Rate 2021 will sometimes glitch and take you a long time to try different solutions. Oregon Statewide Transit Tax 2021 will sometimes glitch and take you a long time to try different solutions.

The Trimet Self Employment Tax Solid State Tax Service

Taxable base tax rate.

. Current Tax Rate Filing Due Dates. Oregon withholding tax tables. Unemployment Insurance Oregon Federal.

Formulas and tables. 2021 tax y ear rates and tables. LoginAsk is here to help you access Oregon Statewide Transit Tax 2021 quickly and.

The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates. Help users access the login page while offering essential notes during the login process. Tax rate used in calculating Oregon state tax for year 2021.

Check the box for the quarter in which the statewide transit tax. Beginning with returns filed in January 2021 businesses and payroll service providers will have the ability to file the Statewide Transit Tax returns in bulk. Cigarette and tobacco products tax.

A Statewide transit tax is being implemented for the State of Oregon. Full-year resident Form OR -40 filers. Oregon employers must withhold 01 0001.

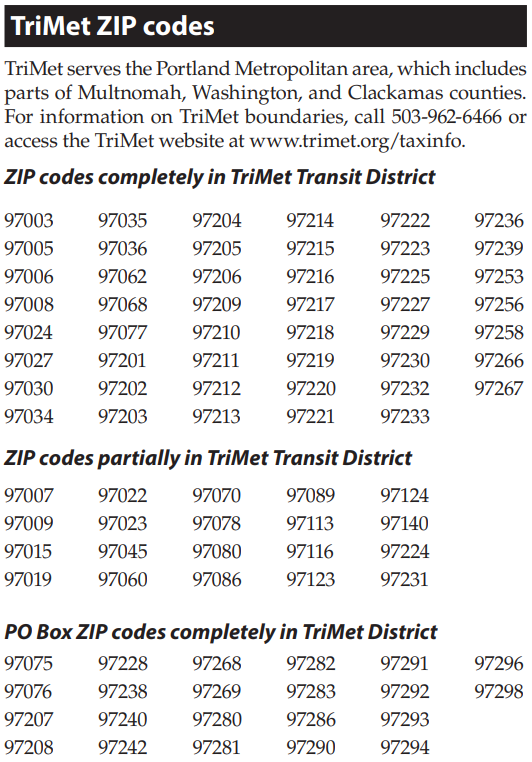

Oregon Transit Payroll Taxes for Employers Following are the 2022 district transit. Cigarette and tobacco products tax. The tax rate is 010 percent.

Transient lodging administration page. Formulas and tables. The Oregon Department of Revenue.

This change is effective for calendar year 2019. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Supplemental Wage Bonus Rate.

Oregon withholding tax tables. Ezpaycheck How To Handle Oregon Statewide Transit Tax b 500000 or. LoginAsk is here to help you access Oregon Statewide Transit Tax Rate.

There is no maximum wage base. For the 2021 tax year Oregons standard deduction allows taxpayers to reduce their taxable income by 2350 for single filers 4700 for those married filing jointly 3780 for heads of. Statewide Transit Tax - Employee 2022 Deduction.

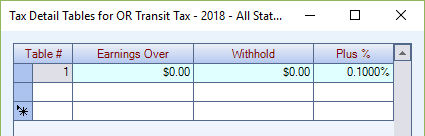

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. 01 of taxable wages. Starting July 1 2018 the tax which is one-tenth of 1 percent or 0001 must be.

The Oregon State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Oregon State Tax Calculator. Transient lodging administration page. On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from.

24 new employer rate Special payroll tax offset. Oregon employers are responsible for withholding the new statewide transit tax from employee wages. The detailed information for Oregon Transit Tax Rate 2021 is provided.

Part-year resident and nonresident Form OR-40-P and Form OR-40-N filers. Oregon salary tax calculator for the tax year 202122. The transit tax will include the following.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Planning For Oregon S New State Taxes Coldstream Wealth Management

The Trimet Self Employment Tax Solid State Tax Service

Sales Taxes In The United States Wikipedia

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Oregon Transit Tax Procare Support

Odot Gets Additional 120 Million For Ballooning I 205 Freeway Expansion Budget Bikeportland

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Transit Payroll Tax Information City Of Wilsonville Oregon

Colorado Sales Tax Rate Rates Calculator Avalara

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Fill Free Fillable Forms For The State Of Oregon